Search for topics or resources

Enter your search below and hit enter or click the search icon.

June 14th, 2024

3 min read

Finding the right insurance model for your business has its fair share of challenges. The traditional market tends to keep information behind the curtain, like the Wizard of Oz. With captives, you have a better look behind the curtain, only to find multiple captive insurance models to choose from. So which one is best for you?

Single-parent and group captives might be more straightforward in the naming scheme. Cell captives are a different story.

What is a cell captive? A cell captive is an insurance setup where different entities utilize a shared structure, each having its own individual “cell” to manage its risk separately. How are they beneficial? And what are their drawbacks?

ReNu Insurance Group works with captive insurers, whether single-parent, group, or cell captives. We have high-level designations and understand the intricacies of captives. With our access to cell captives, we know their ins and outs.

After reading this article, you’ll learn what cell captives are, the basics, their benefits, drawbacks, and ideal businesses suitable for this insurance alternative. That way, you can see if cell captives are right for you or if you want to look at other captive insurance models, such as single-parent or group captives.

From here, you might wonder if a captive insurer is ideal for your business. Take this assessment before you continue to learn how captives could increase your cost savings!

Table of contents:

This system allows businesses to maintain individualized risk strategies with a larger captive framework. The cell captive allows businesses to “rent” a portion of an existing captive insurance company.

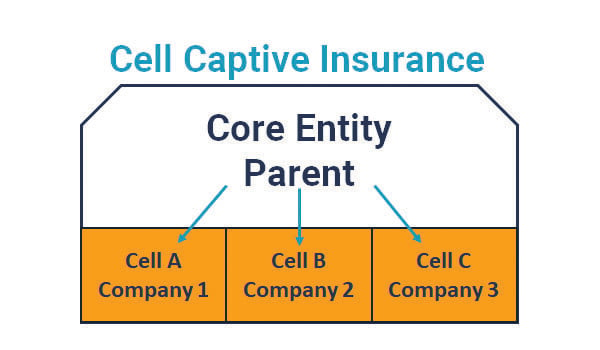

In a cell captive, the core entity called the “parent” establishes a captive insurance company and creates individual “cells” for businesses to rent. Each cell is independent from one another, meaning the assets and liabilities of each cell are legally separated from the others. This is important because it allows the risks and financial results of one cell not to impact the other.

When you join a cell captive, you don’t have any ownership over the insurance company. Compare this to a group captive, where you’re a partial owner with other entities, and a single-parent captive, where your business is the sole owner of the insurance entity.

While the benefits for cell captives are certainly compelling, there are some drawbacks for you to really consider.

Cell captives are particularly appealing to businesses that:

Captive insurers aren’t right for everyone, though they might be ideal for you. Cell captives are a great tool for businesses looking to have more control and stability over their insurance needs. They offer the benefits of captive insurance–such as cost savings customization and improved risk management–without the financial expectations of a business establishing its own captive.

It could be that other captive insurance structures are better for your business. That’s why you need to read our article on the pros and cons of single-parent and group captives.

You might be wondering about your capital investment and underwriting profit for when you join a captive. Take our insurance calculator to get your results.

Warren, the president and founder of ReNu Insurance, shifted from being a commercial pilot to the insurance industry after 9/11. He applied his aviation safety and risk management skills to insurance, creating ReNu's captive insurance model. This approach cuts costs and turns insurance into a strategic asset. An authority in captive insurance with advanced certifications, Warren drives innovative risk management solutions. Under his leadership, ReNu Insurance sets new standards, offering practical and financially smart risk management. Warren Cleveland, ACI, CIC, AAI

Topics: