If your client is getting crushed with renewal premiums year after year and you’re the one delivering that bad news, then you’ve probably asked the same question they have: Isn’t there a better way to buy insurance?

There is. But the traditional system isn’t built to make it easy.

At Captive Coalition, we work with independent agents like you to help clients rethink how they buy insurance, whether they stay in the traditional market or move outside of it entirely.

In this article, we’ll break down:

- Why the current insurance system often punishes well-run businesses

- What options exist for clients who want more control and lower costs

- And how you can help them switch to a smarter insurance strategy

Why Is Buying Insurance So Frustrating for Your Clients?

Carriers claim they’re making it easier with stuff like online portals, quote engines, and digital binders. But for most businesses, the “easy button” just leads to stripped-down coverage and zero personalization.

They're trying to put a computer in front of your client's policy.

Your client might not realize what’s missing until it’s too late. The contract language is dense, the endorsements are buried, and many of these fast-track policies leave huge gaps.

Example: A cheaper auto policy that excludes uninsured motorists might save money upfront, but when your client’s employee gets hit by an uninsured driver, it’s a financial mess they didn’t see coming.

And for mid-market businesses? The situation’s even worse.

Most underwriting happens without ever talking to your client. Applications go into a portal, boxes get checked, and out comes a number. No one looks at their actual risk profile. No one rewards them for doing things right.

Is the Insurance Industry Making Things Complicated on Purpose?

Not exactly. The way it’s structured creates problems for your clients.

Carriers want efficiency. Faster quoting, fewer touchpoints, more automation. That sounds good in theory. However, in practice, it means:

- Policies are templated and transactional

- Underwriting relies on data, not dialogue

- Clients are asked to interpret jargon they’ve never seen before

So yes, it’s “easier” to buy insurance. But it’s harder to buy it well. Your clients often don’t realize the difference until a claim exposes the gaps.

Most underwriters aren’t trying to deceive anyone. But the system isn’t built to educate or advise. It’s built to move product.

Why Should Your Client Change the Way They Buy Insurance?

If your client hasn’t changed their buying strategy in 10–15 years, it’s time to ask: What’s actually working in their favor?

Shopping rates with 10 carriers every year might feel proactive. In reality, it’s just playing the price game. It doesn’t change how the underwriter views their risk. It doesn’t improve how claims are handled. And it definitely doesn’t create long-term cost control.

The big question is: What have they changed that would make a carrier give them a better deal?

If the answer is “nothing,” then it might be time for a shift in strategy.

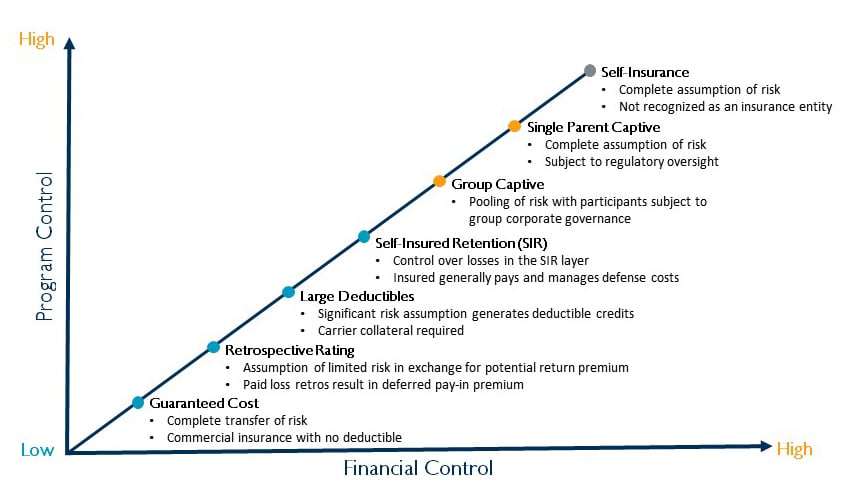

That doesn’t always mean leaving the traditional market. It might mean embracing structures that reward risk ownership, like:

Taking on more risk isn’t for every client. Some are content paying higher premiums in exchange for less responsibility. That’s valid.

But for clients who want more control and better financial outcomes, how they buy insurance has to change

If you’re looking for more financial control (X-axis) over your insurance premiums, the guaranteed cost route might not be in your best interest. However, it does mean you have to have more program control (Y-axis) over your business's safety and risk management. It depends on what you’re willing to pay and the risk you’re taking on.

How Can Your Client Actually Make the Switch?

The first step is mindset. If your client wants to lower insurance costs, they need to decide whether they’re ready to take on more risk in exchange for more control.

Here’s what that might look like:

- High-Deductible Plans

Your client absorbs smaller losses and uses the carrier for big events only. Premiums drop—but they need to be ready to fund claims early.

- Self-Insured Retention (SIR)

Similar to high deductibles, but your client pays claims directly up to a set threshold before the insurer kicks in. More control, more responsibility.

- Retrospective Rating Plans

Premiums are adjusted based on actual loss experience. If your client runs a safe business, they win.

- Captive Insurance

They form or join a captive to fully own their risk—and potentially profit from strong performance.

Here are the big questions to help them answer: How much risk are they willing to take? And are they prepared to manage it well?

If the answer is yes, there are better strategies waiting. And if they want to stay in the traditional market, they can still play smarter.

Help Your Clients With Smarter Insurance Strategies

At the end of the day, the traditional market isn’t designed to reward well-run businesses. If your client wants lower costs and better control, they have to change how they approach insurance.

Help them understand the trade-offs. Show them what risk ownership looks like. And walk them through the models that actually align with how they operate.

Start with our article on the key differences between traditional, captive, and self-insurance for a more comprehensive depth of each model. You can also learn more about captive insurance with our Captive Insurance 101 Guide for Independent Agents.

Then, help them decide what risk they’re willing to carry and how they want their insurance dollars to work for them.

Want more resources to better help your best clients and maintain your book of business? Become a member of Captive Coalition for FREE.