Search for topics or resources

Enter your search below and hit enter or click the search icon.

August 13th, 2024

3 min read

Knowing about captive insurers as a concept is already difficult, even for the best insurance agents. Putting the financial aspects in perspective is like taking a 102-level class. And that’s fair for anyone who has primarily worked in the traditional market. Captives are a foreign concept for most people.

Thankfully, Captive Coalition makes understanding captives digestible for independent insurance agents and their clients. We understand captives and how they have financially benefited the best clients who have robust safety and risk management programs.

This article will help you understand the financial advantages of captive insurance, how clients see benefits, taxation, and how captives improve business profitability. That way, you and your best clients can determine whether or not captive insurers would be a good fit.

Captive insurance is an alternative to traditional insurance, where its insureds wholly own and control the insurer. Captives are a long-term insurance strategy that allows businesses to earn underwriting profit and manage risk.

They incentivize businesses to implement robust safety and risk management programs to lower the number of claims, which directly impacts their insurance costs.

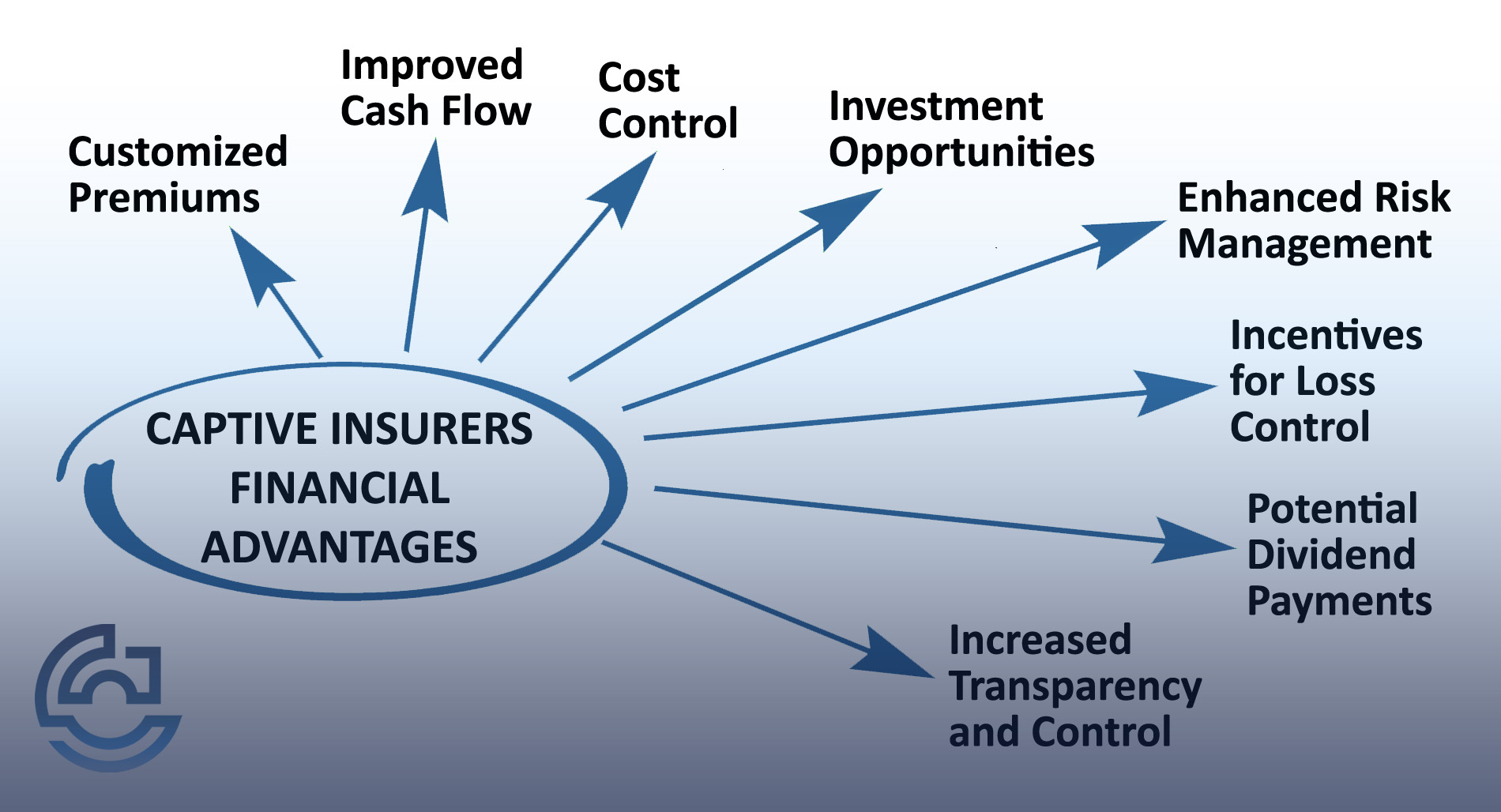

Some financial advantages to consider with captives are:

Captive insurance offers financial benefits like cost control, cash flow improvement, and better risk management for your client's business.

Before getting into the nitty gritty, you might wonder if your clients are suitable for captives. Take the captive assessment to get those results.

Industry-wide claims often influence premium costs for traditional insurers. Captives allow businesses to set premiums based on their risk profile and claim loss history. For instance, a construction company with little to no claims won't have to pay higher premiums because the industry as a whole is experiencing more claims.

Businesses that manage their risks well can see significant savings. Typically, businesses with good loss experience can reduce renewal premiums by 28% in the first three years.

Captive owners can also retain underwriting profit and investment income, enhancing cash flow (assuming no change in claims experience).

Funds that would normally go to paying premiums can be invested within the captive, offering potential growth and additional financial benefits.

By managing risks directly, businesses can reduce the frequency and severity of claims, leading to long-term savings. This proactive approach to risk management can result in long-term savings and more control over insurance costs.

With traditional insurance, a portion of every premium dollar is set aside for potential losses, with any surplus becoming the insurance company’s profit. With captives, that profit goes back to the business.

Captives encourage businesses to implement more robust safety and risk management strategies. Focusing directly on the risks that matter to the business can reduce overall losses, leading to better possibilities. A healthier work environment can have a more positive impact on employee morale and productivity.

In the traditional market, business owners have no idea where each cent is allocated. As for captives, business owners see exactly how their premiums are used. This transparency leads to more informed decision-making and a better understanding of the business’s risk profile.

If the captive performs well financially, the business may receive dividend payments. These payments are a return of surplus funds, which can be reinvested into the business, used for future premiums, or distributed to stakeholders.

There are, but it’s important to note that captives should be formed for risk management and business needs. They are a long-term insurance strategy. Entering solely for tax benefits can attract IRS scrutiny.

Here are some tax benefits:

Premiums paid to a captive insurance company are usually tax-deductible, lowering the overall tax liability.

Businesses can defer taxes on underwriting profits and investment income until they are distributed, which helps with cash flow and allows for reinvestment.

Captives aren't only a form of insuring your client's business. They can give your best clients long-term benefits.

Captive insurance offers a range of benefits, including cost control, improved cash flow, and enhanced risk management. Understanding these benefits allows independent insurance agents like you to help your clients and ensure their insurance needs will be fulfilled.

While captive insurers have their financial advantages, you want to ensure you understand their financial disadvantages. That way, you can compare and see whether the pros outweigh the cons for your client.

If you have more questions about captives and want to see if they are suited for your clients, schedule a call to talk to an insurance advisor at Captive Coalition.